FREEAnalytics Portal

£19.95

Monthly Cost

Monthly Cost

£0.00

upfront cost

upfront cost

Next Day

Settlement Time

No Contract

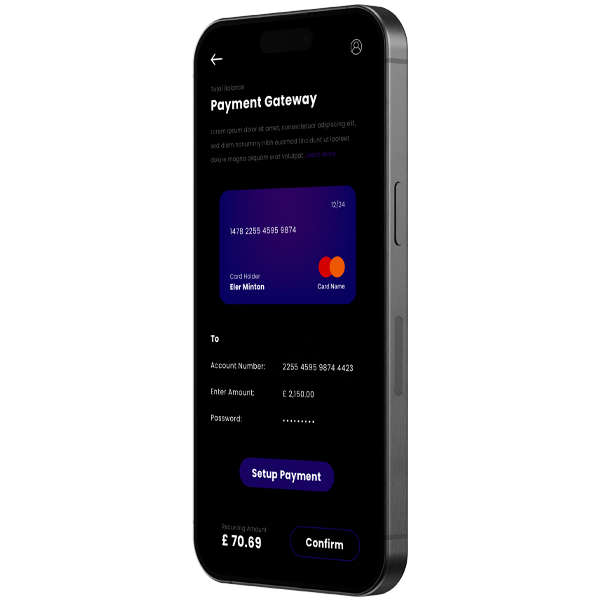

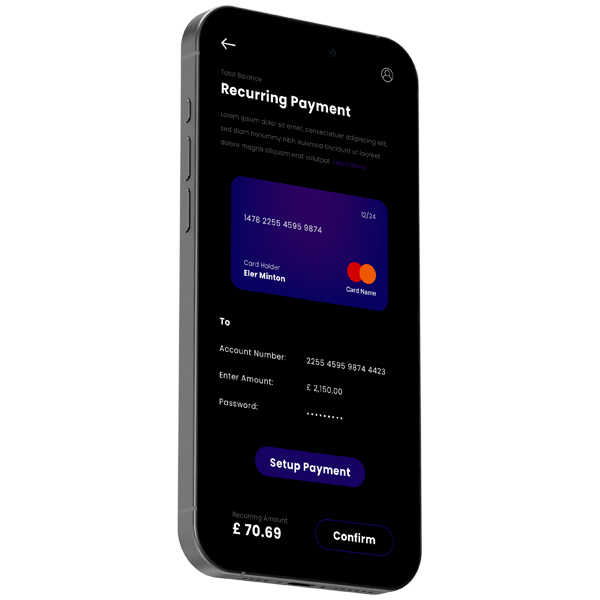

Payment GatewaySettlement Time

Device Type Website, Telephone, Link, Recurring

Website Payments – Payment Link – Telephone Payment – Recurring Payment – WorldPay

Worldpay offers solutions for website payments, telephone payments, and payment links to enable businesses to accept payments from customers in various ways. Website payments handle online transactions, while telephone payments allow for processing payments over the phone. Payment Link is a specific service where businesses can generate a unique payment link to send to customers for a secure, online checkout, even without a website.

Package Benefits

- Accept payments in 170+ countries

- Seamless single integration setup

- Wider payment method options

- Reduce cart abandonment rates

- Lower processing costs globally

- Improve transaction authorization rates

Pricing

£19.95 monthly cost

£0.00 upfront cost

Average Rates

The Average Rates stated here are based on industry average rates. Get in touch now for your own personalised quotes.

- Consumer Debit 0.9% + £0.10

- Consumer Credit 1.23% + £0.10

- Business Debit 2% + £0.10

- Business Credit 2.7% + £0.10

- Authorisation Fee 3p